Analyzing the best Systematic Investment Plans (SIPs) involves evaluating funds based on performance, risk, and alignment with your financial goals. Here are some top SIP options to consider in 2025:

Parag Parikh Flexi Cap Fund – Direct Growth

A diversified fund investing across market capitalizations and sectors, aiming for long-term capital appreciation. Key sectors include Financial, Services, Technology, Energy, and Automobile. Top holdings are Bajaj Holdings & Investment Ltd., Power Grid Corporation of India Ltd., Coal India Ltd., ITC Ltd., and HCL Technologies Ltd.

**Parag Parikh Flexi Cap Fund – Direct Growth**

A diversified fund investing across market capitalizations and sectors, aiming for long-term capital appreciation. Key sectors include Financial, Services, Technology, Energy, and Automobile. Top holdings are Bajaj Holdings & Investment Ltd., Power Grid Corporation of India Ltd., Coal India Ltd., ITC Ltd., and HCL Technologies Ltd. 10Quant Large and Mid Cap Fund – Direct Growth

This fund focuses on large and mid-cap companies, balancing stability and growth potential. Key sectors include Consumer Staples, Energy, Metals & Mining, Financial, and Services. Top holdings are Reliance Industries Ltd., ITC Ltd., Aurobindo Pharma Ltd., Lloyds Metals & Energy Ltd., and Larsen & Toubro Ltd.

**Quant Large and Mid Cap Fund – Direct Growth**

This fund focuses on large and mid-cap companies, balancing stability and growth potential. Key sectors include Consumer Staples, Energy, Metals & Mining, Financial, and Services. Top holdings are Reliance Industries Ltd., ITC Ltd., Aurobindo Pharma Ltd., Lloyds Metals & Energy Ltd., and Larsen & Toubro Ltd. 18Quant Active Fund – Direct Growth

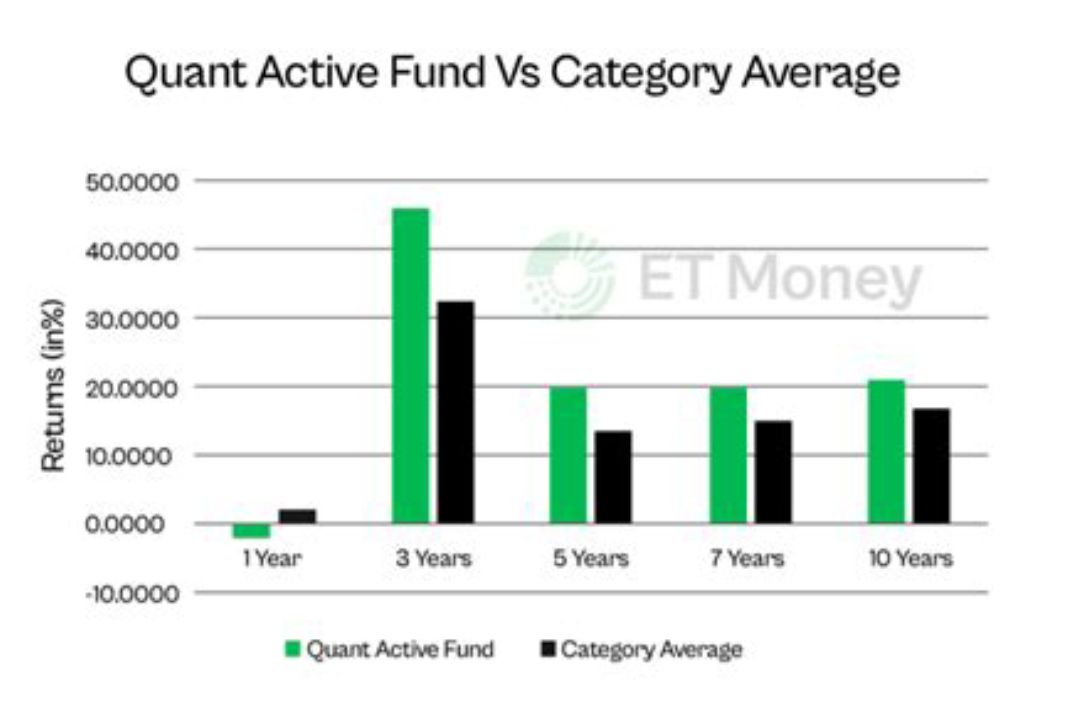

A multi-cap fund investing across various sectors and market capitalizations for diversified growth. Key sectors include Services, Construction, Financial, Energy, and Consumer Staples. Top holdings are Reliance Industries Ltd., Aurobindo Pharma Ltd., ITC Ltd., Swan Energy Ltd., and Larsen & Toubro Ltd.

**Quant Active Fund – Direct Growth**

A multi-cap fund investing across various sectors and market capitalizations for diversified growth. Key sectors include Services, Construction, Financial, Energy, and Consumer Staples. Top holdings are Reliance Industries Ltd., Aurobindo Pharma Ltd., ITC Ltd., Swan Energy Ltd., and Larsen & Toubro Ltd. 26Edelweiss Large & Mid Cap Fund – Direct Growth

This fund invests in a mix of large and mid-cap companies, aiming for capital appreciation. Key sectors include Financial, Technology, Capital Goods, Healthcare, and Services. Top holdings are HDFC Bank Ltd., ICICI Bank Ltd., Dixon Technologies (India) Ltd., Persistent Systems Ltd., and Trent Ltd

**Edelweiss Large & Mid Cap Fund – Direct Growth**

This fund invests in a mix of large and mid-cap companies, aiming for capital appreciation. Key sectors include Financial, Technology, Capital Goods, Healthcare, and Services. Top holdings are HDFC Bank Ltd., ICICI Bank Ltd., Dixon Technologies (India) Ltd., Persistent Systems Ltd., and Trent Ltd

No Responses